Capital Structure Financing assets with debt and equity

Capital Structure

Financing assets with debt and equity

Article shared by

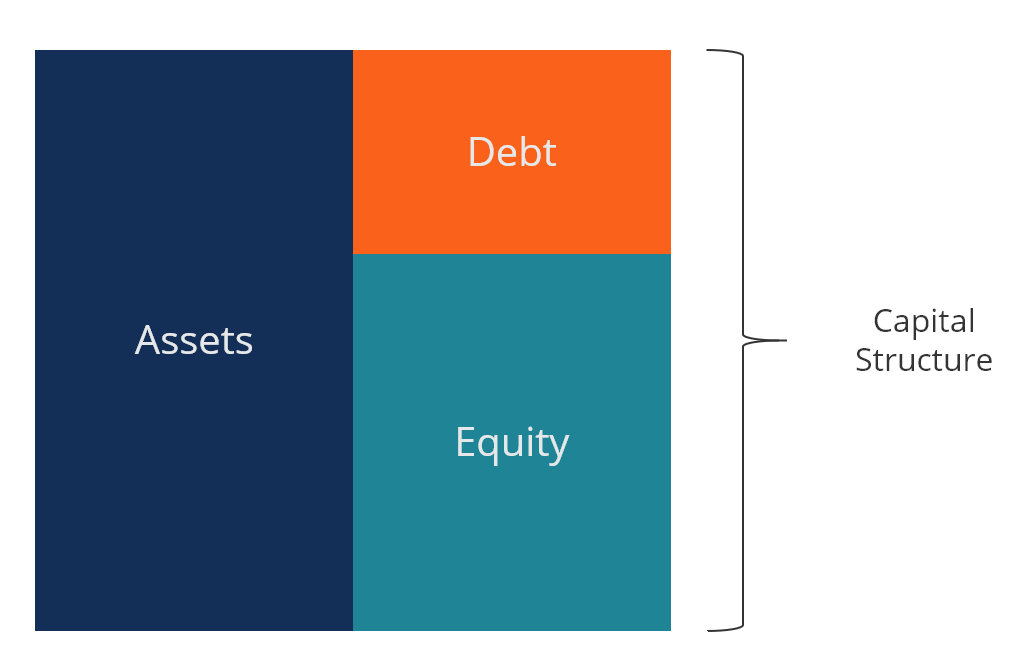

What is capital structure?

Capital Structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. The structure is typically expressed as a debt-to-equity or debt-to-capital ratio.

Debt and equity capital are used to fund a business’ operations, capital expenditures, acquisitions, and other investments. There are tradeoffs firms have to make when they decide whether to raise debt or equity and managers will balance the two try and find the optimal capital structure.

Optimal capital structure

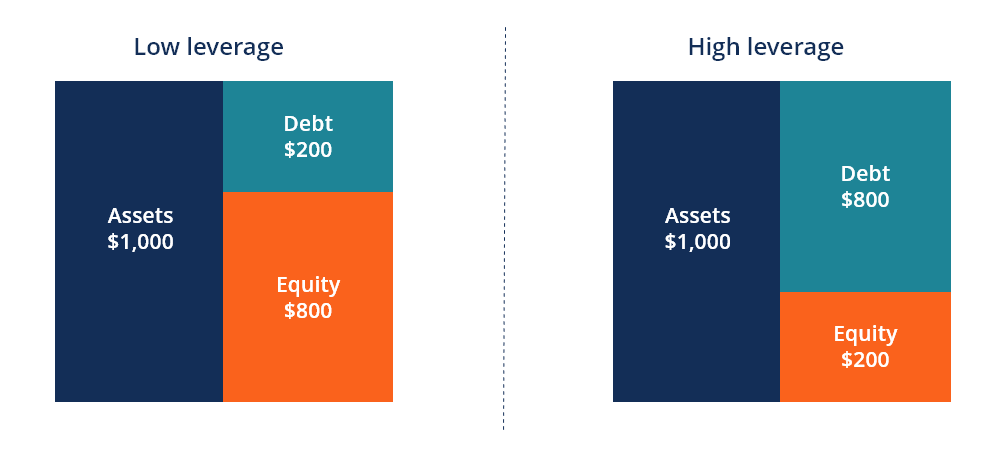

The optimal capital structure of a firm is often defined as the proportion of debt and equity that result in the lowest weighted average cost of capital (WACC) for the firm. This technical definition is not always used in practice, and firms often have a strategic or philosophical view of what the structure should be.

In order to optimize the structure, a firm will decide if it needs more debt or equity and can issue whichever it requires. The new capital that’s issued may be used to invest in new assets or may be used to repurchase debt/equity that’s currently outstanding as a form or recapitalization.

Dynamics of debt and equity

Below is an illustration of the dynamics between debt and equity from the view of investors and the firm.

Debt investors take less risk because they have the first claim on the assets of the business in the event of bankruptcy. For this reason, they accept a lower rate of return, and thus the firm has a lower cost of capital when it issues debt compared to equity.

Equity investors take more risk as they only receive the residual value after debt investors have been repaid. In exchange for this risk equity investors expect a higher rate of return and therefore the implied cost of equity is greater than that of debt.

Cost of capital

A firm’s total cost of capital is a weighted average of the cost of equity and the cost of debt, known as the weighted average cost of capital (WACC).

The formula is equal to:

WACC = (E/V x Re) + ((D/V x Rd) x (1 – T))

Where:

E = market value of the firm’s equity (market cap)

D = market value of the firm’s debt

V = total value of capital (equity plus debt)

E/V = percentage of capital that is equity

D/V = percentage of capital that is debt

Re = cost of equity (required rate of return)

Rd = cost of debt (yield to maturity on existing debt)

T = tax rate

D = market value of the firm’s debt

V = total value of capital (equity plus debt)

E/V = percentage of capital that is equity

D/V = percentage of capital that is debt

Re = cost of equity (required rate of return)

Rd = cost of debt (yield to maturity on existing debt)

T = tax rate

Comments

Post a Comment